Challenges And Requirements

01Business relies on the branch office, making it difficult to market when away from the office.

02How to coordinate online and offline application verification through multiple channels.

03Customer managers need to return to the branch office to view customer information, leading to low efficiency.

04VIP customers are too busy to visit the branch office, which may result in business loss.

05Long queue times during peak business hours make customers wait for a long time to handle business at the counter.

Solution

TECHOWN Information provides a flexible and fast mobile card issuing solution (including debit and credit cards) for bank marketers. This solution allows bank marketers to handle business outside the branch office with a PAD, enabling them to quickly process card issuing through the PAD application front-end at any time and any place, without being limited by the counter operating hours. This makes it more convenient and faster for marketers to handle business operations.

Mobile card opening process

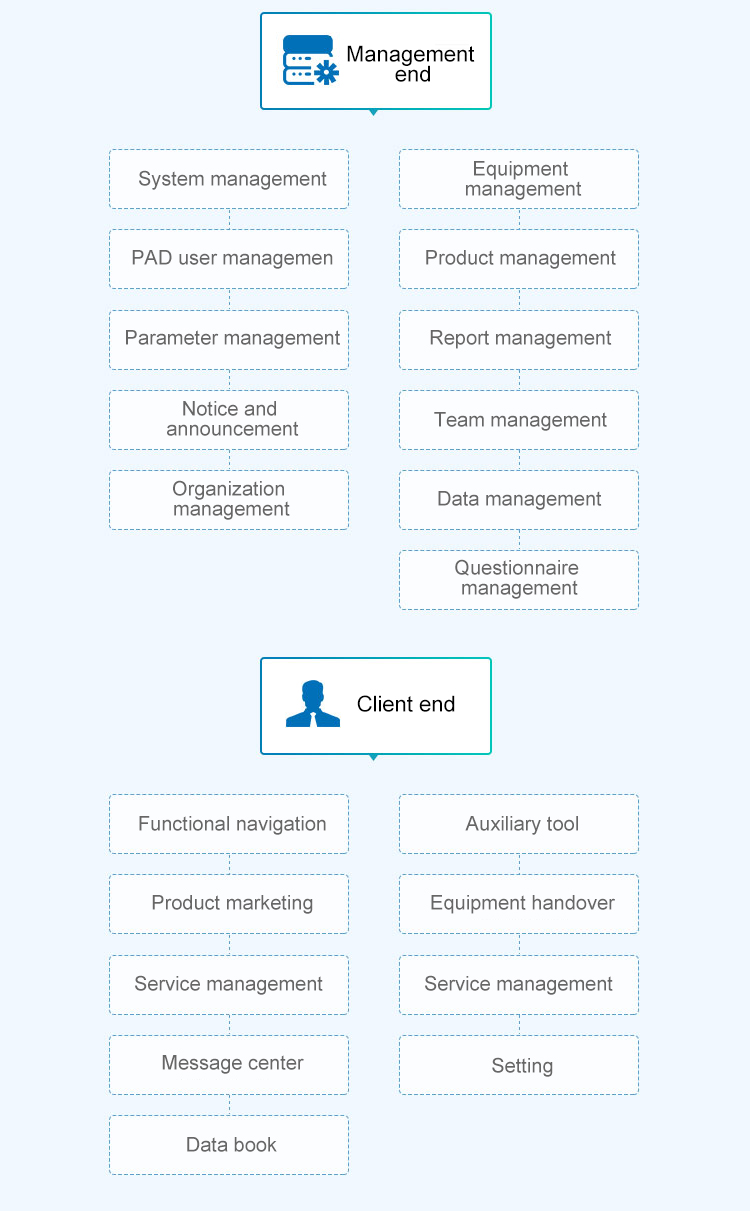

Platform functions

What we Can Do For The Bank

Transaction methods

•Replace various paper-based certificates with paperless transactions and electronic information

•Expand sales methods and bring sales closer to the market and customers

Information security and accuracy

•Reduce manual input and decrease the risk of fraudulent information input

•Use mobile internet technology to achieve networked management and precise marketing

Product promotion

•More flexible promotion means to showcase customer-needed products at any time and place

•Quick acceptance and rapid completion