Why Is It Mobile?

In traditional mobile credit, most banks are still using traditional business handling methods. What problems does the traditional handling method bring to the financial industry?

How to deal with so much paper materials?

How to improve the business ability of customer managers?

How to manage customer managers who go out?

TECHOWN Information Mobile Credit Solution helps enterprises in the financial industry to build an electronic credit mobile platform, which will replace paper application forms within a certain range, realize on-site acceptance of business, and integrate with the back-end business processing system to greatly improve the efficiency of central business processing and risk management capabilities. At the same time, the terminal reserves a flexible expandable interface, which can increase the promotion and marketing of other businesses according to the needs of other businesses, and promote cross-selling.

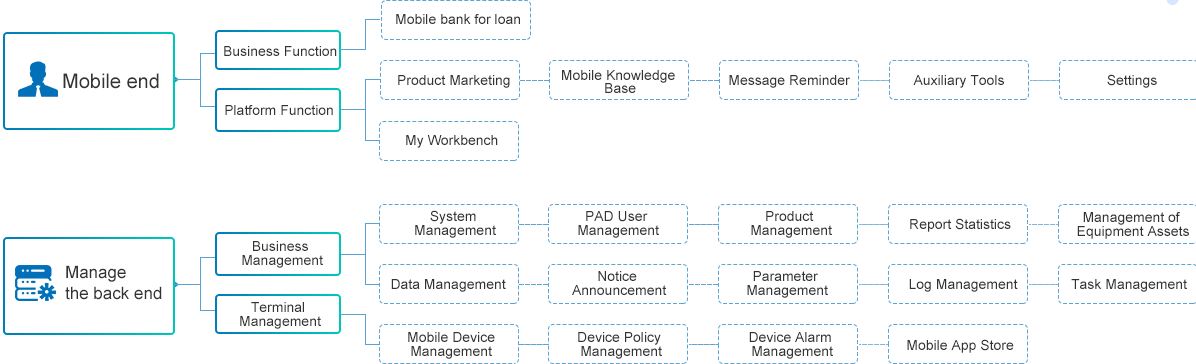

Functional Module

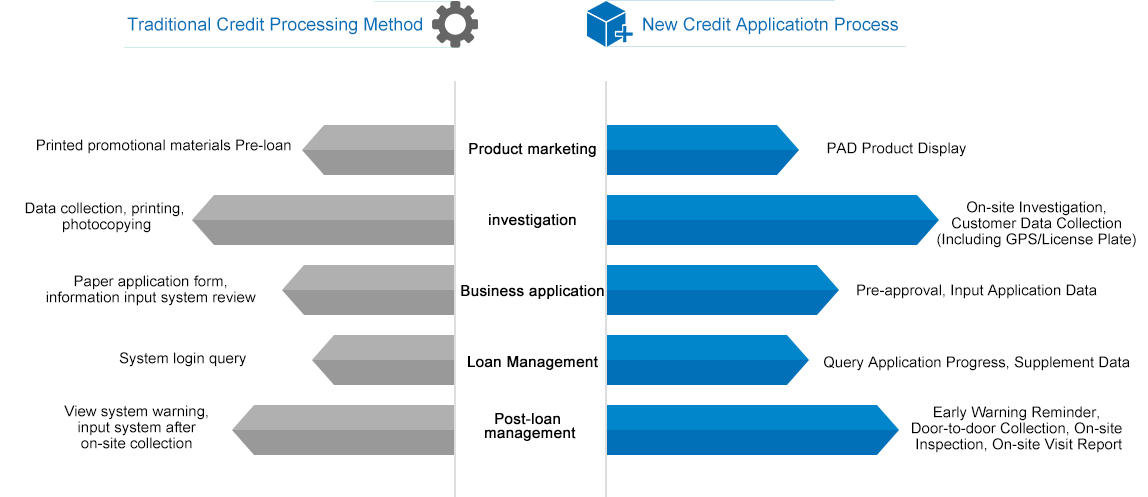

Comparison Between Traditional Mobile Credit And New Mobile Credit

Technical Features

Multiple login modes

In addition to supporting the traditional username and password login mode, it also supports the two popular market login modes, gesture password login and fingerprint password login.

Face recognition

Simple, efficient, and accurate comparison and recognition of ID photos and on-site handheld ID photos.

Voice input

Compared to traditional keyboard input, voice input technology is simple and fast.

Location service

Through trajectory management, geographic fence function to achieve attendance tracking of business personnel, standardize the business area; customer view, line and navigation, work order management and other functions, to facilitate business personnel familiar with customer information and planning to-do items.

Second Generation Identity Card Recognition

Implement the input of the second generation ID card information and verify the authenticity of the ID card information through interaction with the public security network system.

Electronic signature

Electronic signature through capacitive pen or finger, and archiving, to achieve the security risk control of business.

User behavior analysis

Multi-dimensional and multi-indicator analysis of user retention rate and overall user usage trends.

OCR technology

Supports multiple media input such as ID card, bank card, license plate number, enterprise three certificates, financial statements, etc., to speed up input speed, improve work efficiency and accuracy, and reduce the work intensity of non-professional input personnel.

Customer Returns

• Greatly improve the efficiency of loans, optimize the process and reduce costs;

• Through online verification of loan qualifications, effectively reduce malicious loan fraud;

• Take pictures and recognize data, network encryption transmission, centralized database storage, protect customer privacy;

• Standardize business processes, prevent illegal operations, simplify operation processes, friendly operation training;

• Mobile marketing program, locate the business acceptance location, and form a trajectory for the business personnel to visit outside.